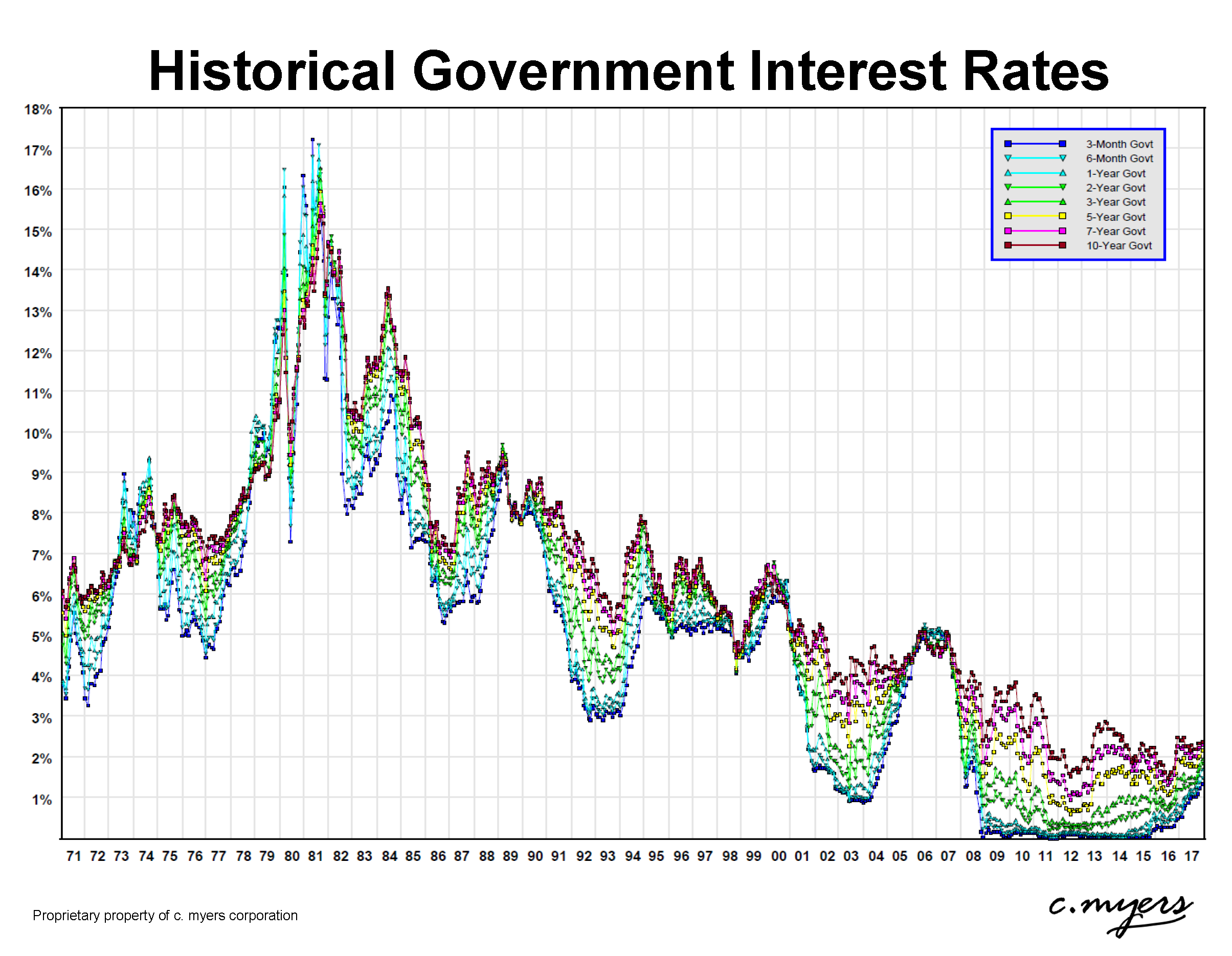

Webjul 29, 2020 · the business interest expense deduction limitation does not apply to certain small businesses whose gross receipts are $26 million or less, electing real property. Webfor taxable years beginning after december 31, 2017, the limitation applies to all taxpayers who have business interest expense, other than certain small businesses that meet the. Websep 1, 2019 · for tax years beginning after 2017, the deduction for business interest expense cannot exceed the sum of the taxpayer's: Floor plan financing interest expense.

Recent Post

- Pitts And Spitts Problems

- Lisa Lynn Simmons Of Garland Texas Current Address

- Bulk Supplements Nitric Oxide

- 6 Inch Porch Columns

- Aspen Dental Snap On Dentures Cost

- Mugshots Anderson Sc

- Ridgid 20v Battery

- Appleton Wi Obituaries

- Green Bay Arrest Reports

- Cargo Van Transportation Jobs

- Dailydiapers Board

- Obituaries Westmoreland County Pa

- Why Did Generikb Leave Hermitcraft

- Simplisafe Sensor Range Extender

- Wholesale Feed Store Supplies

Trending Keywords

Recent Search

- Krissy Cox Monroe Mi

- My Singing Monsters Soundboard

- Rebel Wilson Imdb

- Wbrz Traffic Cameras

- Break Up Spells With Lemon

- Private Duty Nursing Jobs For Lpn

- Uw Lab Medicine

- Modesto Police Breaking News

- Va Optum Provider Phone Number

- Generac Generator Oil Requirements

- Indian Roommates In Nashville

- Who Gave Nicolle Wallace Her Turquoise Necklace

- Railroad Salvage Furniture

- Ethan Ralph Kiwi Farms

- Propane At Sheetz

![How To Write A Letter Of Interest In 2021 [Examples + Template] | Steve How To Write A Letter Of Interest In 2021 [Examples + Template] | Steve](https://blog.hubspot.com/hs-fs/hubfs/Sample Letter of Interest Example.png?width=2318&name=Sample Letter of Interest Example.png)