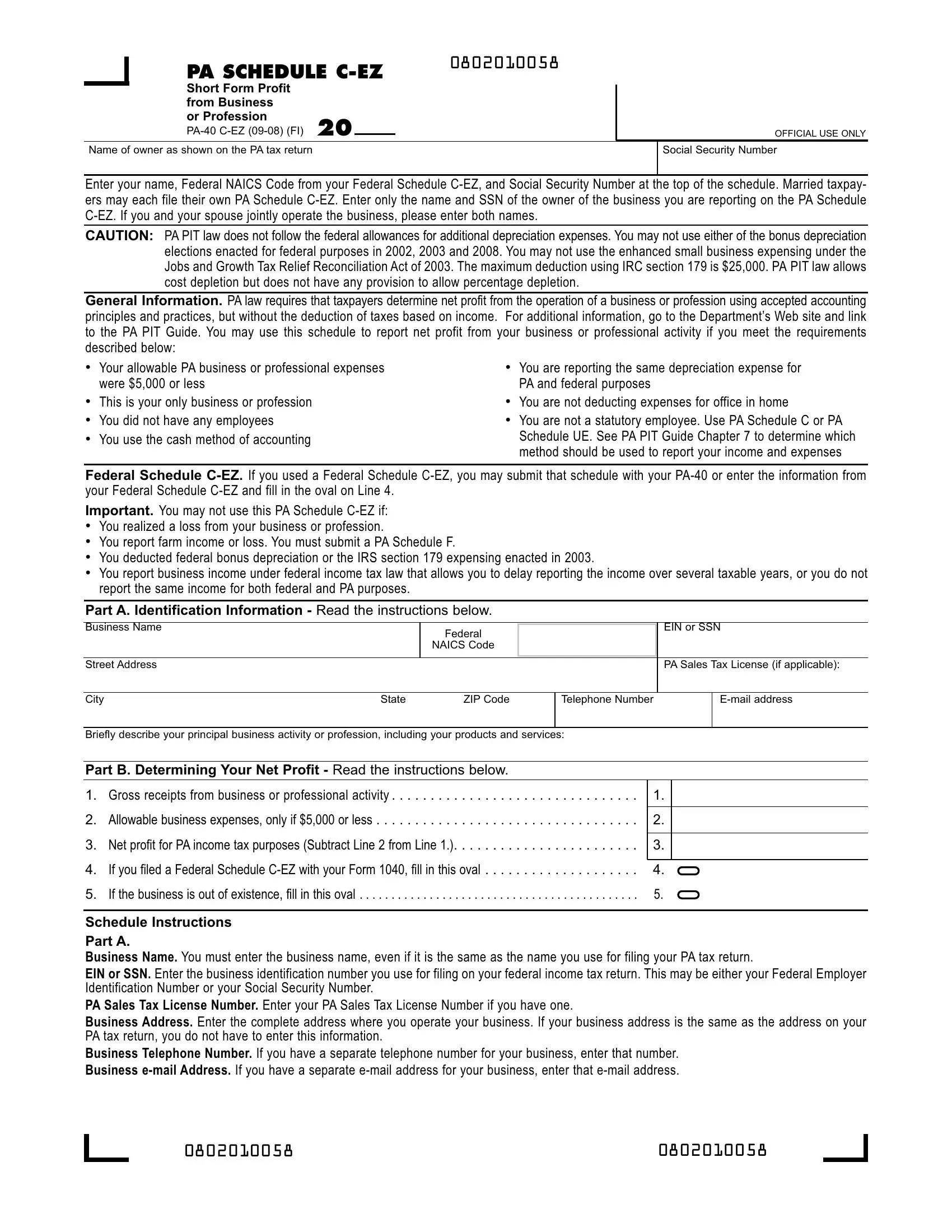

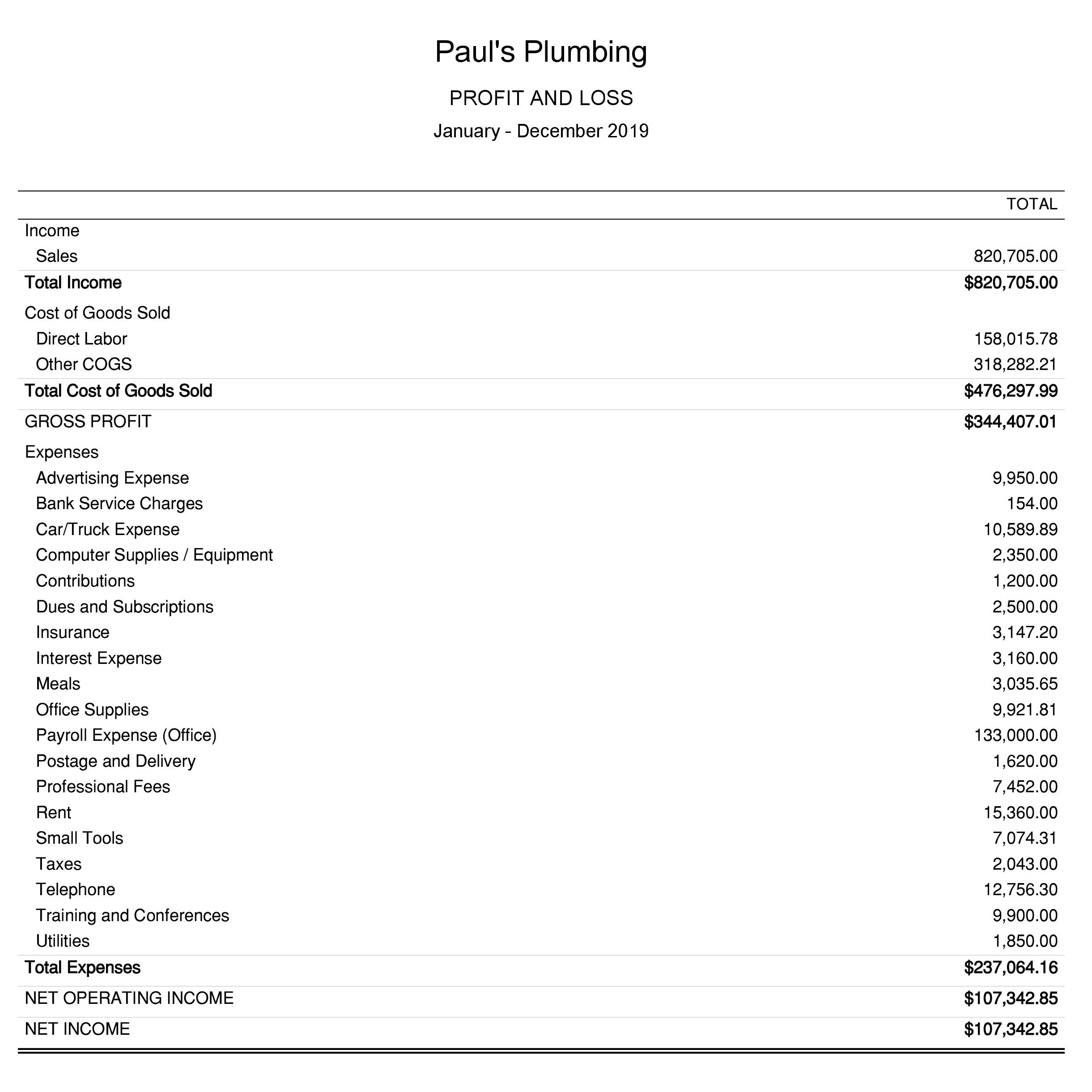

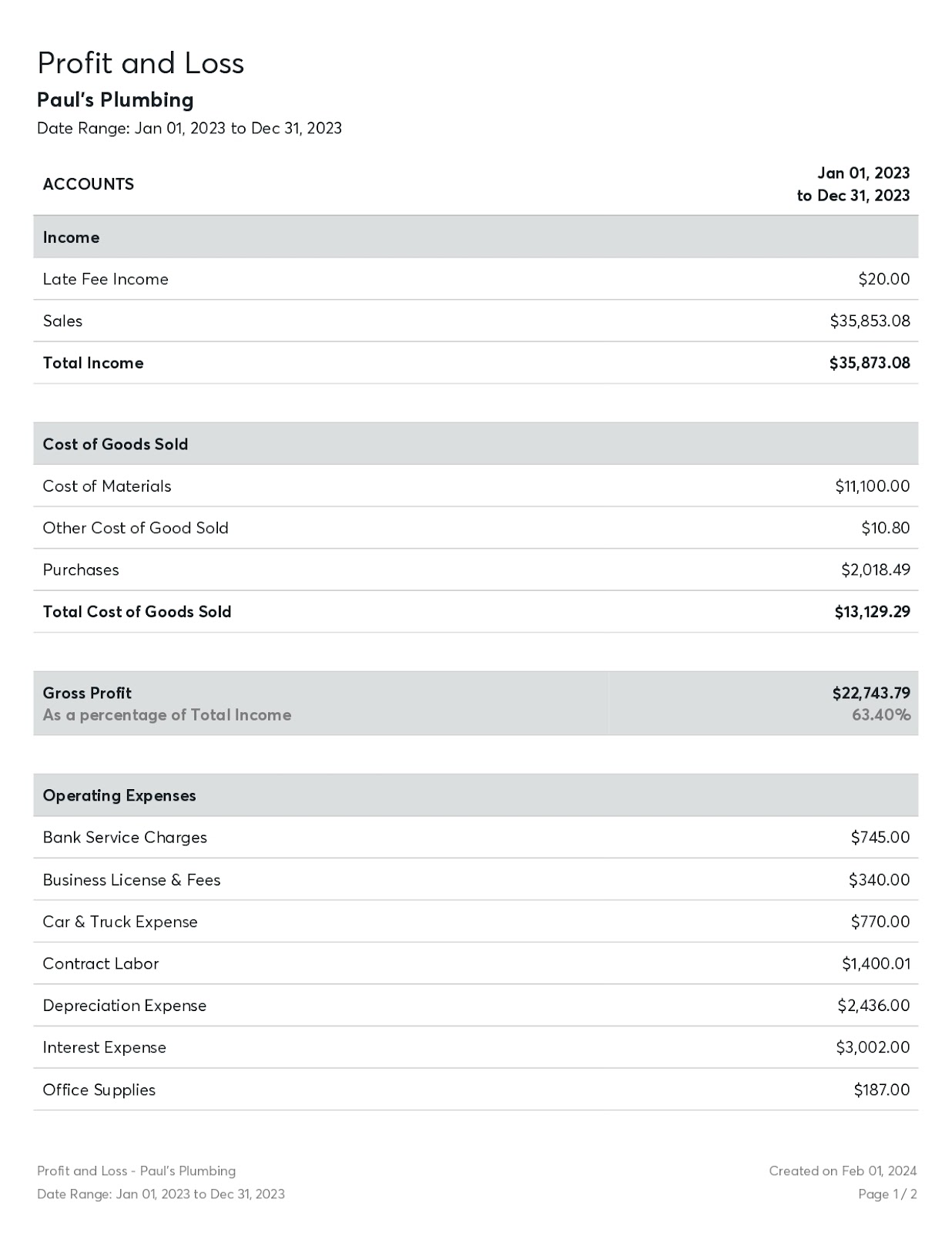

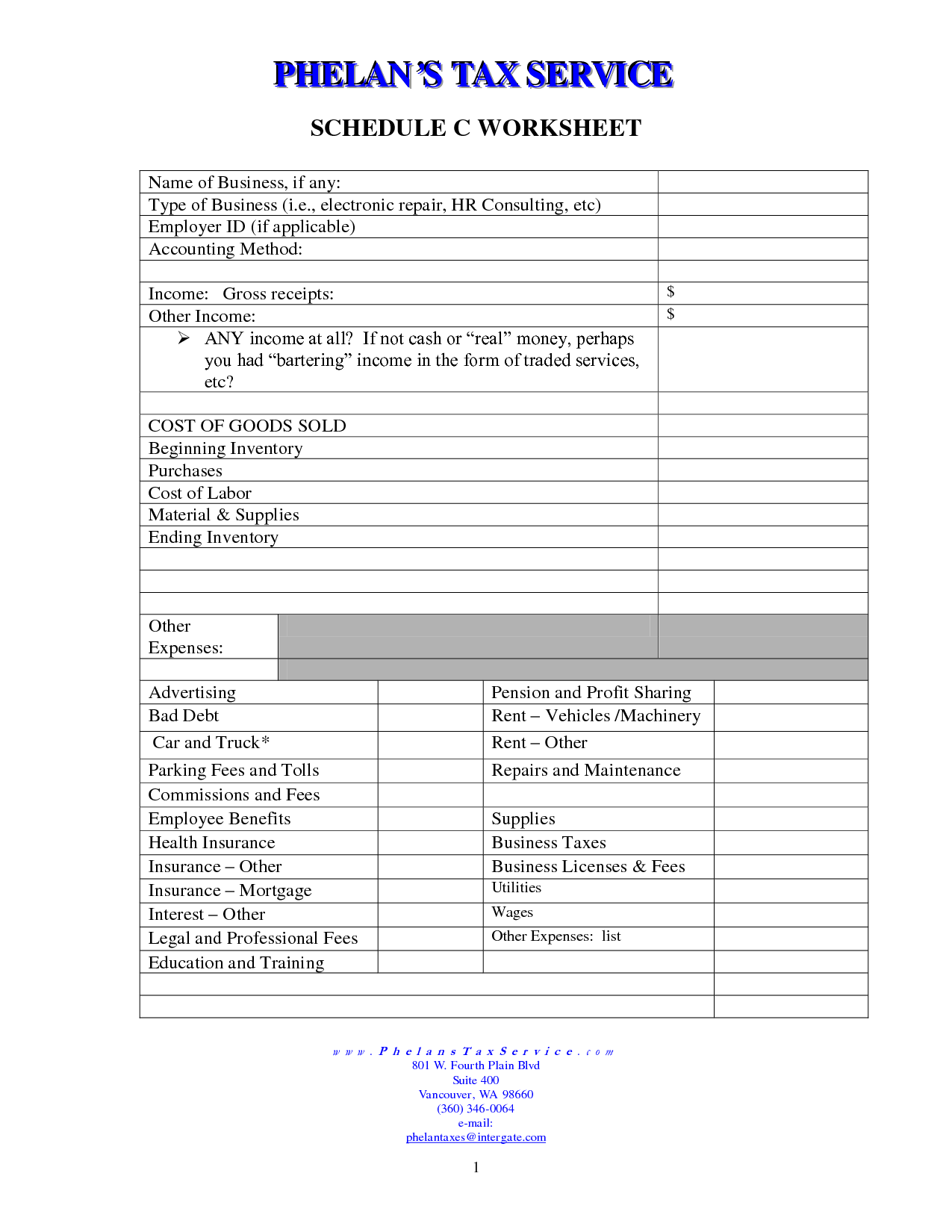

Websep 19, 2022 · schedule c is the linchpin of your independent contractor taxes. It's the form that lets you claim business expenses regardless of whether you itemize your tax. Webfilling out schedule c for your doordash business is a relatively straightforward process. Here are the key sections and questions you need to pay attention to: Webfilling out a schedule c is one of the most effective ways for doordash contractors to pay only what they owe in taxes. Documenting their business income and expenses ensures. If you want to deduct expenses related to your income then you will need. Webuse schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if your.

Related Posts

Recent Post

- Rest Of Season Fantasy Rankings

- Indeed Jobs Memphis Tn

- Anahiem Weather

- Dallas First 48 Episodes

- Arapahoe County Colorado Court Docket

- College Confidential Latest

- Friends Share Girlfriends

- Female Inmate Pen Pals

- Tupelo Daily Journal News

- Cheryl Scott Wedding Pictures

- Easy Upper Level Electives Umd

- Harbor Freight Job

- Gabrielle Soft White Underbelly

- Let Me See You Do It Lyrics

- Night Work From Home Jobs Part Time

Trending Keywords

Recent Search

- 101 Dalmatians Street Deviantart

- Chance Hart Ftm

- Mock Draft

- Simmons Funeral Home

- Superstition Cremation And Funeral Services

- Oak Island Female Cast Members

- Ferry Funeral Home Nevada Mo

- Danielle Colby Social Media

- Blount County Jail Inmates Mugshots Today

- 1 Bedroom Apartments For Rent All Utilities Included

- Verizon Sto

- Rbt Training Jobs

- View From My Seat Ppg Paints Arena

- Deedee Crime Scene Photos

- Taylor Swift Pregnant Tmz

/GettyImages-174038203-5a4d1e6de258f80036c28e70.jpg)

:max_bytes(150000):strip_icc()/ScheduleD2022IRS-11353a1e824e41a9a83f83e39fd0f879.jpg)

:max_bytes(150000):strip_icc()/ScheduleC-ProfitorLossfromBusiness-1-2b9fe42e669342c783bbaae69e570415.png)