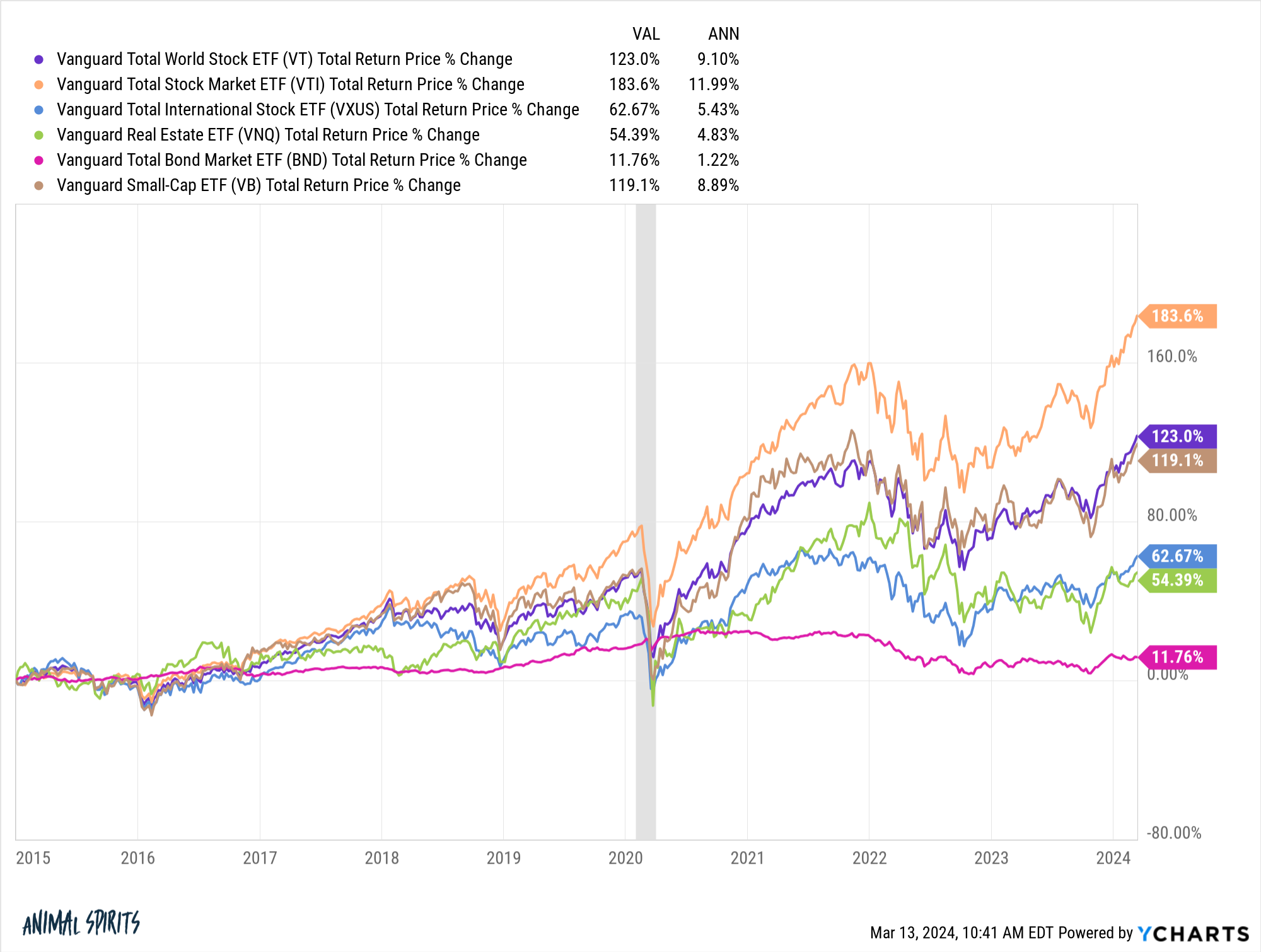

Webthe most ideal thing is to rebalance vti/vxus. If you have 100m nw then it saves you a lot. If you’re Point is there is no wrong. Weboct 4, 2024 · compare and contrast key facts about vanguard total stock market etf (vti) and vanguard total international stock etf (vxus). Vti and vxus are both. It compares fees, performance, dividend yield, holdings, technical indicators, and many other metrics that. Webfrom a financial standpoint, vti + vxus > vt only if you allocate / rebalance properly. While you can do better due to the slightly lower fees, human emotion / error in the. Webassuming a market weight equity portfolio, if you hold vtsax+vxus instead of vt then 40% of your equity would be vxus, so the value of the ftc would be 0. 09% (0. 23 * 40%) or greater than the entire expense ratio. Webcompare vti and vxus etfs on current and historical performance, aum, flows, holdings, costs, esg ratings, and many other metrics.

Recent Post

- Hvac Subcontractor Jobs

- What Are Antitrust Laws Quizlet

- Cbs Fantasy Football

- What Other Show Was Jessi And Chris Morse On

- Jobs Hiring Near Me 20 Plus An Hour

- Zillow Beaver County

- Pickaway Sheriff Active Inmates

- Zillow Apartment Rentals

- Week 12 Picks Straight Up

- Charles Oakley Dates Joined

- Weekly Ad Target

- Danny Koker Jail

- Indeed Overnight Jobs

- Harborfields Public Library

- Quizlet 27 Amendments

Trending Keywords

Recent Search

- Home Access Center Alief Isd

- R Antimlm

- Do Scorpios Feel Bad When They Hurt Someone

- Big Reno Gun Show

- Zillow Rialto

- Comal County News

- Tulip Chinese Massage Spa

- Lemons Wattpad

- Zillow Seneca Sc

- Weed Delivery Driver Jobs

- Brittany Mahomes Taylor Swift Meme

- Geico Commercial

- Rankings Week 7

- Tripadvisor Cancun Forum

- Tony Evans Youtube

_14.jpg)